(If you don’t know much about Bitcoin, please read the excellent introduction posted at the MIT Technology Review by Tom Simonite. You may also want to read the recent paper by Reuben Grinberg, a J.D. candidate at the Yale Law School.) [Update: The Economist has published a fantastic article.]

In less than a year, the price of Bitcoin has increased from close to zero to nearly $9 as I write this (see below), prompting the digerati to question, only half-jokingly, if Bitcoin prices are in a “bubble” – see this post by economist Tyler Cowen for a typical example. For the underlying conventional wisdom is that use of Bitcoin is highly unlikely ever to expand beyond a few niche markets – e.g., idealistic hackers, online gamblers, and miscellaneous underground characters.

I disagree with the conventional wisdom: I’m persuaded that in the long run (think many years or even decades, not just a few years), Bitcoin is likely to gain wide adoption worldwide, and its price is therefore bound to rise far above current levels over time.

Before explaining why and how, allow me to take a brief detour to discuss what happened in Zimbabwe on January 29, 2009 – just over two years ago. On that date, the BBC reported that this poor nation was forced to abandon its currency, the Zimbabwean dollar, because virtually no one inside or outside the country trusted it anymore. As I write this, Zimbabwe doesn’t have an official currency: for the moment its citizens are free to conduct business in any currency.

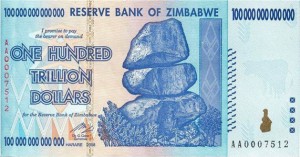

Hyperinflation led to the Zimbabwean dollar’s demise. The facts are almost surreal. At one point in early 2007, in an act of desperation, the government tried to control inflation by declaring it illegal, such that anyone who raised prices or wages would go to jail; in response, prices and wages began rising at a faster rate. By July 2008, the official inflation rate reached over 231,000,000%; the following month, the government stopped reporting inflation altogether. Not long after that, a newly issued hundred-trillion-dollar bill couldn’t even buy a bus ticket; by then just about everyone everywhere had lost faith in the currency.

This Zimbabwean dollar bill was issued shortly before the currency’s demise. (Image source: Wikipedia)

Words cannot do justice to the chaos and terror inflicted by the demise of a currency: regular folk lose both their normal repository of purchasing power and their normal means of measuring the worth of everything – for many, degree of need becomes the new yardstick of value. As things spiral out of control, monetary authorities in desperation react by imposing increasingly draconian rules that serve only to accelerate the process. Those who can turn to the US dollar, gold – anything, really, that can possibly hold its purchasing power, so long as it’s not the dying currency.

Had it been possible and practical circa 2007, surely many desperate Zimbabweans would have traded at least some of their soon-to-be-obsolete Zimbabwean dollars for a global, digital currency actively traded abroad – especially one that is anonymous and decentralized like Bitcoin: better bitcoins of debatable value than Zimbabwean dollars of vanishing value. (By “practical,” I mean easy enough to buy, sell, and use for most individuals in the country.)

The same could be said for the people of Yugoslavia in the early 1990’s, who at one point saw newly issued banknotes with additional zeros worthless within days; or Argentines circa 2001, when their government subjected them to the so-called “corralito” – the nickname given to a law forbidding withdrawals from many bank accounts; or Mexicans in December 1994, when the Peso lost around half of its value against the US dollar in a couple of weeks as the Mexican government flirted with default; or Belarusians in the years leading to 2002; or Bolivians in the mid-1980’s; or Brazilians in the early 1990’s; or the Polish circa 1991; or Russians in August 1998; or Indonesians, South Koreans, and Thais in the summer of 1997… I could go on. The list of countries that have suffered a currency crisis, hyperinflation, or the outright demise of an official currency over the past few decades is long.

The number of people alive who have suffered through such currency disasters is therefore enormous – around a billion live in just the countries mentioned above.

Argentines protesting the “corralito” of 2001-2002. The sign reads “THIEVING BANKS – GIVE BACK OUR DOLLARS.” (Image source: Wikipedia)

The number grows considerably larger if we include all people who have suffered through other types of man-made disasters, whether economic crises, political turmoil, religious and ethnic strife, revolution, or war. (As a reference point, Wikipedia lists over 100 wars occurring worldwide since 1990.) The expanded figure is in the order of billions of people – a sobering fact for anyone who has experienced only the relative stability of the developed world in his or her lifetime. (In late 2008, people in the developed world got only but a brief hint of how it might feel to suffer through such full-on disasters.)

When people are forced by fate to face the extreme uncertainty of such circumstances, they often seek to diversify away from local currencies facing existential risk and turn to the US dollar, gold, or anything else, really, that can possibly hold its purchasing power under all but the most dire of scenarios. Unsurprisingly, a majority of all US dollar bills in circulation – the cumbersome ones made of actual paper – are held outside the US, for when even the viability of banks has been rendered in doubt, no bank deposit can ever substitute for cash.

Had it been possible and practical (in the sense explained further above) when things looked hopeless, surely many among those billions of people would have traded at least some of their holdings of local currency for a global, decentralized, anonymous, digital currency actively traded abroad – especially one with the properties of Bitcoin.

Properties of Bitcoin

Bitcoin is not just global, decentralized, and (optionally) anonymous; it is also the most versatile form of cash introduced to date. For a bitcoin is just a long sequence of digits with certain cryptographic attributes, so anything one can do with numbers, one can just as easily do with it. In practical terms, this means Bitcoin is easier to secure, transport, hide, and backup than all prior forms of cash ever used by civilization. (Actually, no prior form of cash ever in use – whether made of paper, metal, or other material – could be backed up like Bitcoin.)

As an arbitrary example of Bitcoin’s extreme versatility, imagine, say, a US government agent in hostile territory who needs to send cash to a second agent located a few miles away, but there is no safe transportation, no phone line, no Internet connection, and no third party who could serve as an intermediary. With Bitcoin, it can be done: the first agent can enter a transaction (or even encrypt a bitcoin wallet) on any computing device, and send the resulting sequence of encrypted digits via almost any means available: radio broadcast, lighthouse beam, drumbeats, even smoke signals. (Transmitting many thousands of digits via smoke signals might take a long time, but it can be done.) Anyone intercepting the message would obtain just the encrypted sequence. Whether embodied as radio signals, light beams, sound waves, or columns of smoke, actual cash would be securely traveling from one agent to the other. Being numbers, bitcoins can be sent over almost any medium.

Having been only recently introduced, at the moment Bitcoin requires a minimum of technical expertise to use (specifically, installing a software application on a personal computer). However, judging by the growing number of new tools, services, and infrastructure being developed worldwide for and around Bitcoin, I would expect it to become much easier to use in the not too distant future – easy enough, say, for anyone who can use a mobile phone.

Bitcoins are much harder to forge than paper currencies, because the sequence of digits that makes up each bitcoin is practically impossible to replicate without access to the original. In fact, it’s easier for a criminal to make counterfeit US dollar bills that can fool people on the street than to make ‘counterfeit bitcoins’ that can fool Bitcoin’s peer-to-peer network: the former can be accomplished with paper, ink, and printing equipment; the latter would require breaking state-of-the-art cryptographic hashing (currently SHA-256 and RIPEMD-160) and signing (currently ECDSA) algorithms.

Bitcoins are scarce by design – their number will grow to a maximum of 21 million by 2030 – but, being numbers, they can be subdivided into arbitrarily smaller parts. (At the moment, subdivision is limited for practical purposes to eight decimal points of precision, but this limit is not inherent to the design.) The subdivided parts of a bitcoin, being numbers too, have the same exact properties as the whole; thus, should the need ever arise, the world could just as easily deal in milli-Bitcoin (a thousandth of a bitcoin), micro-Bitcoin (a millionth), etc. as in Bitcoin.

Finally, as the first-ever form of “crypto-cash” to gain brand recognition and market momentum, Bitcoin is now benefiting from growing network effects. Bitcoin, in short, has gone viral – something that would be extremely difficult, if not impossible to replicate by any would-be competitors. (As a side note, I can’t help but smirk whenever some or other expert on the subject of cryptography finds out about Bitcoin and almost immediately proposes some other design as superior, failing to realize that at this point it doesn’t matter.)

Intrinsic Value versus Price of Bitcoins

Adam Smith, the father of modern economics, distinguished between “value in use” and “value in exchange” – in his own words:

The word VALUE, it is to be observed, has two different meanings, and sometimes expresses the utility of some particular object, and sometimes the power of purchasing other goods which the possession of that object conveys. The one may be called ‘value in use;’ the other, ‘value in exchange.’ The things which have the greatest value in use have frequently little or no value in exchange; on the contrary, those which have the greatest value in exchange have frequently little or no value in use. Nothing is more useful than water: but it will purchase scarce anything; scarce anything can be had in exchange for it. A diamond, on the contrary, has scarce any use-value; but a very great quantity of other goods may frequently be had in exchange for it.

Bitcoins, being just numbers, have zero use-value. (Actually, their use-value is slightly negative, because they have tiny carrying costs – every moment one holds a bitcoin, one is paying for it with the consumption of resources such as storage space or electricity; but we can ignore these tiny carrying costs.)

Thus bitcoins can have only value in exchange: to the owner of a bitcoin, its value depends solely on what other people are willing to trade for it; should no one else want to trade anything for it (for example, if Bitcoin’s network were ever shown to be susceptible to concerted attack), the bitcoin’s exchange-value would revert to its use-value: zero.

For the sake of familiarity, let’s use the more common terms “intrinsic value” and “price,” respectively, to refer to the concepts of value in use and value in exchange. We can restate the above as follows: Bitcoin has no intrinsic value but may trade at any price, as set by supply and demand. In this regard, Bitcoin is like all other currencies in circulation today.

Trial by Fire

Given that over the past few decades billions of people have suffered financial, economic, and political crises and collapses, religious and ethnic conflicts, revolutions, and wars, shouldn’t we expect billions to live through more such man-made disasters in the coming decades?

The optimist in me hopes there are no more such horrible disasters anywhere in the world ever again; the realist in me has no choice but to expect them to occur from time to time.

In fact, they are always occurring. As I write this, European countries like Portugal, Ireland, Greece, and Spain are staring down at full-blown economic and political crises, and the Middle East is in the midst of a sudden, unexpected wave of political transformation, the ultimate consequences of which are uncertain.

The anonymity, decentralized nature, and extreme versatility of Bitcoin make it an ideal form of cash for coping with the extreme uncertainty inherent to such unstable situations. Financial crises, collapsed economies, toppled governments, military conflicts: Bitcoin can survive them all.

As Bitcoin becomes easier to buy, sell, and use by regular folk, its use in extreme, difficult circumstances therefore seems inevitable to me. When people are desperate, they tend to be more willing to try new things. So long as Bitcoin works as intended, people around the planet are bound to turn to it as the currency and store or value of last resort.

Trial by fire: that is how Bitcoin will have to prove its mettle.

If Bitcoin passes the harsh tests of crisis again and again, it will slowly gain credibility in the public’s mind, both as medium of exchange and store of value. Over a period of many years or even decades, as the world gradually learns via trial-and-error how to use Bitcoin, becomes familiar with its properties, and ultimately comes to trust it, nothing can prevent it from gaining as much credibility as, say, gold.

The world’s existing legal and regulatory regimes may not welcome Bitcoin at first – few governments are likely to take kindly to the emergence of a decentralized, anonymous, global currency beyond their control. Sooner or later, however, governments will adapt to the changing circumstances, as they always do. I would expect governmental acceptance of Bitcoin to occur initially in less developed countries, as many of them are already used to having their fortunes tied to a global currency beyond their control: the US dollar.

If I am right, in the long run, as man-made crises of all kinds erupt all over the planet from time to time, global adoption of Bitcoin should gradually expand from niche markets to the broader population. Ultimately, global adoption for Bitcoin should be enormous.

Quantifying Potential Adoption for Bitcoin in the Long Run

The primary goal of the analysis that follows is to get the orders of magnitude roughly right, not to come up with precise figures that would surely be wrong. A secondary goal is to provide you, the reader, with a simple framework you can use to quantify Bitcoin adoption (and potential price) based on your own views about its future.

Global adoption for Bitcoin over time should come in two forms: adoption of it as medium of exchange, and as store of value. Let’s consider the former first.

We can guesstimate maximum possible global adoption for Bitcoin as medium of exchange with a mental experiment. Imagine if all countries worldwide decided, en masse, to replace all currencies in circulation with bitcoins, all at the same time, in coordinated fashion – more or less in the same way that the initial members of the European Monetary Union replaced their respective national currencies (German Marks, French Francs, Italian Lire, etc.) with the euro on December 31, 1998. Obviously, such a wholesale replacement of all currencies for bitcoins will never happen, but please entertain the notion for a moment.

For such a replacement to be completed, all cash across all currencies carried around in wallets, locked in cash registers, packed in briefcases, stored under mattresses, secured inside safes, etc. – the total amount of ‘pocket change,’ as it were, the world needs to function every day – would have to be exchanged for bitcoins. The remaining components of the world’s monetary base (e.g., bank deposits, money funds, etc.), which by and large exist only in the form of accounting entries, would continue to exist as such, but denominated in bitcoins. (This is just like what was done to create the euro.) [Ed note: there are some additional complications involved that I feel are not worth delving into here — e.g., see this comment on Reddit.]

Immediately after this wholesale replacement of all currencies, Bitcoin would be, to a close approximation, the only medium of exchange in the planet. Since everyone would be using Bitcoin, adoption of as a medium of exchange would have reached its “maximum possible.” It follows that total cash in circulation across all currencies (or more precisely, the goods and services that could be purchased with it) constitutes a good guesstimate of maximum possible global adoption for bitcoins as medium of exchange at any point in time.

How much cash in circulation is there worldwide? According to the US Federal Reserve, as of May 2, 2011, the aggregate value of all US dollars in circulation is approximately $955 billion. According to the European Central Bank, at the end of March 2011, the aggregate value of all euros in circulation is approximately €846 billion (€824 billion in large denominations and €22 billion in small denominations), equivalent to approximately $1.2 trillion at current exchange rates. The aggregate market value of all US dollar and euro bills in circulation worldwide, at current exchange rates, is therefore around $2.2 trillion.

The US dollar and euro economies, in nominal terms, represent approximately half of the world’s annual economic output, so, all else being equal, we can assume that the aggregate market value of all other currencies in circulation used by all other economies in the world, at current exchange rates, is likely around $2.2 trillion too. (The figure may be lower because the US dollar and euro may enjoy wider use as “hard” currencies, but it could also be higher, because most of those other economies have lesser developed financial systems and therefore tend to rely much more on physical cash as opposed to electronic transactions. For simplicity’s sake, let’s assume the figure is roughly the same.)

Thus cash in circulation today, across all currencies, totals around $4.4 trillion. You can think of this rough figure as the amount of pocket change the world needs, in total, to function every day. With world population currently estimated at nearly 6.8 billion, this works out to roughly $650 for every person alive. This per-person average seems reasonable to me given that it includes not just all cash held by individuals, but also that held across all organizations.

Should a sufficiently large group of people ever adopt Bitcoin as their main medium of exchange, all else being the same, they would need around $650 worth of bitcoins in ‘pocket change’ circulating for every person in the group.

Potential adoption of bitcoins as store of value is much harder to quantify, because so many types of assets – both financial assets like cash itself, bank deposits, government bonds, and shares of common stock, as well as real assets like property, artwork, jewelry, and precious metals – are regularly used for this purpose. I know of no way to estimate, in any remotely accurate way, which of all those assets, nor to what extent, could ever be displaced by Bitcoin as a store of value. (Complicating matters, the figures involved are barely fathomable. According to McKinsey & Co., just the world’s financial assets totaled approximately $178 trillion at year-end 2008, or roughly 40 times the amount of cash in circulation worldwide.)

Perhaps the most comparable asset to Bitcoin as a store of value might be gold: throughout history it has been used for that purpose; its physical stock is fixed to the amount that ultimately can be mined from the ground; its ownership can be anonymous; there is no single central authority that controls it; it pays no interest; and by and large no one uses it as currency today.

So let’s limit ourselves to estimating what the adoption of Bitcoin as store of value might be should the world ever adopt it for that purpose to the same extent as gold today. This would be in addition to any adoption of Bitcoin as medium of exchange.

According to the World Gold Council, 165,000 tons of gold have been mined since the beginning of civilization, all of which are still with us. At $1,525 per troy ounce, all this gold is currently worth around $8.1 trillion. The World Gold Council estimates that over a third is held by investors and central banks for investment, worth approximately $2.7 trillion, or around $400 for every person alive. This, roughly, is how much gold the world owns as store of value.

Should a sufficiently large group of people ever adopt Bitcoin as a store of value to the same extent as gold today, the group would need around $400 worth of bitcoins for every person in it.

Therefore, the world would need on average around $650 worth of bitcoins for every person who adopts it as his or her currency, plus $400 worth of bitcoins for every person who adopts it as a store of value to the same extent gold is used today. Don’t forget that these two figures are, first of all, rough estimates, and second, worldwide averages, so they will vary widely from person to person. Also, please note that both figures are in current US dollars; all else remaining the same, they will grow with US dollar inflation over time.

Bitcoin Price Will Be a Function of Adoption

Using the per-person averages calculated above, we can guesstimate what Bitcoin’s price might be under any adoption scenario.

For example, say that over the next 10 years, 100 million individuals worldwide adopt Bitcoin as a store of value (to the same extent gold is used today), but no one adopts it as a currency, and annual US dollar inflation is 3% over the entire period. By 2021, each of these individuals would need to own an average of $400 × 1.0310 or around $540 worth of bitcoins. Multiplying this figure by 100 million gives us around $54 billion worth of bitcoins needed by all these individuals as a group in 2021. Dividing this last figure by the number of bitcoins then outstanding, around 18.3 million, we obtain $2,950 per bitcoin, or $2.95 per milli-bitcoin (a thousandth of a bitcoin) – so, in the order of a few US dollars per milli-bitcoin.

For a more optimistic (likely unrealistic) scenario, say that over the next 20 years a billion people adopt Bitcoin both as currency and store of value (to the same extent gold is used today), and annual US dollar inflation over the period is 3%. By 2031, each of these individuals would need to own an average of ($650+$400) × 1.0320 or around $1,900 worth of bitcoins. Multiplying this figure by a billion gives us around $1.9 trillion worth of bitcoins needed by the whole group in 2031. Dividing this last figure by the number of bitcoins then outstanding, 21 million, we obtain a price of over $90,000 per bitcoin, or $0.09 per micro-bitcoin (a millionth of a bitcoin) – so, in the order of a handful of US cents per micro-bitcoin.

One thing becomes evident to me from this exercise: should Bitcoin ever gain wide adoption, its price should rise by at least several orders of magnitude. The forecast, of course, will vary widely depending on the assumptions used, so I would encourage you to play with them and reach your own conclusion.

* * *

Addendum

Using reverse logic, we can guesstimate Bitcoin adoption at any time. For instance, as I write this, there are just over 6.3 million bitcoins in existence, each trading for around $9, for a total Bitcoin market capitalization of around $57 million. (You can see the current number of bitcoins in existence here and their current trading price here. [Ed note: BitcoinWatch shows all this data and much more in one place.])

The early adopters who own these bitcoins by and large seem to be hoarding them and speculating like day-traders using Bitcoin as a store of value, not as a currency; and they likely own more than the global average per person of $400 worth of bitcoins we estimated above, because they’re more technologically sophisticated and therefore wealthier than the average person on the planet.

Nominal economic output per capita in developed countries is roughly three to five times higher than for the world as a whole, so let’s say Bitcoin’s early adopters own, on average, four times the $400, or $1,600, worth of bitcoins. Dividing the current market capitalization of $57 million by this last figure, we obtain a guesstimate of current Bitcoin adoption: around 36,000 – so, in the order of a few dozen thousand individuals worldwide.

—

[Ed note: post updated to correct typos, add clarifications and examples, and fix/add some links. Also, replaced the terms “supply” and “demand,” which have precise technical meanings in economics, with words like “stock” and “adoption,” which better convey the intended meaning.]

Interesting read. Lately I’ve been wondering whether to exchange, spend, or hold on to the BTC I’ve mined.

Erik: thanks. As to whether to buy, sell, or hold BTC right now, it wouldn’t be a good idea for me to express an opinion.

Nice essay. A big issue for me is the stability of the bitcoin vs presumably stable government currencies. I first became aware of it today and decided to monitor the exchange rate vs the dollar. I observed a variation of close to 40% in the span of just a few hours. Less than a half day! I understand that this is a natural consequence of free market forces, but that kind of instability can’t possibly inspire any kind of global confidence. It’s just too volatile.

sportscliche: thank you. Note that people suffering through crises of the kinds mentioned above don’t always have the choice of buying US dollars, as governments facing such crises often make it difficult or even illegal to buy them at market rates; thus the choice for many people facing crises in the future will be between bitcoins of debatable (perhaps volatile) value versus some local currency facing existential risk. (Were you in such a difficult situation, which one would you choose?)

Should Bitcoin survive crises again and again, it would *slowly* gain credibility as a currency or store of value *of last resort*. Note the emphasized words. The process of gaining such credibility would not be smooth or quick — it would occur in fits and starts through trial-and-error over many years or even decades.

I see your point, but I still can’t understand how bitcoin is the magic bullet. A government presiding over one of the meltdown examples in your essay may declare use of another currency illegal, but I doubt whether such a law could be realistically enforced. Your Zimbabwe example illustrates this. My point is that a government that is unable to stop runaway inflation doesn’t strike me as one that could effectively police currency alternatives.

No faith in the currency means no faith in the government. I wouldn’t be willing to follow the proclamations of any government that just wiped me out financially. A substitute currency, black market, and even barter system would have to appear out of necessity. If I understand bitcoin correctly — and I fully admit that I probably don’t — a couple of microprocessors have to be involved to make a transaction. Why go to the trouble of acquiring and using a digital currency when I can fill my wallet with cold-hard cash tied to the reasonably stable economy of another country?

sportscliche: I’m counting on Moore’s Law to bring down the cost of personal computing devices (smartphones) dramatically in coming years, and I’m assuming Bitcoin will get much, much easier to use over time — say, to the point that it becomes almost effortless for anyone who can use a mobile phone. So the question should be, why would anyone risk getting caught (or worse in the case of violent crises) to grab cash in paper form when they can get Bitcoin from the comfort of their home by pushing a button?

I’ve copied the following from the article that appeared at SmartMoney.com, which mentions the sock merchant:

“Forster began charging 75 Bitcoins for each pair in February and has since had to lower the price to 5 due to extreme appreciation in the currency’s value. ‘I wish I had kept all of them’ says Forster, who traded his Bitcoins on the way up for cash and web services.”

This short excerpt illustrates two problems with bitcoins that present what I think are serious headwinds to their possible adoption as a legitimate currency. These problems have nothing to do with the fundamental design or implementation of bitcoins, rather the lack of any sense of stability that exists in the exchange markets.

The sock vendor runs the business in dollars, which forces bitcoin transactions through a currency converter. This conversion is in such a dynamic state that the bitcoin price of socks must be constantly revised. A smart vendor would check the exchange rate at the time of any sale. Second and even more important is Forster’s admission that he regrets not hoarding his bitcoins. I don’t blame him, given the runaway price appreciation. I doubt Forster is spending any of the bitcoins he has made in the last few weeks.

I see a significant problem with any commerce based on currency that is so incredibly volatile and unstable. Anyone possessing bitcoins must be constantly asking himself “Should I spend these on something or just hold on to them? They could double next week or the market might crash. What do I do?” The very first post in response to this essay clearly expresses the same uncertainty. I could also ask the question: “Why use them to gamble when just owning is a gambling?”

We live in a world where bitcoins are valued relative to government-issued currency. It would be nice, but I don’t think anyone can naively pretend that dollars, euros, and pounds don’t exist. The reality is there are exchange markets running 24/7. And as long as the speculation and price volatility persists, widespread adoption as a functioning currency can’t happen.

sportscliche: Once you look beyond the major currencies like the US dollar and euro, most currencies in the planet are even more unstable — as evidenced by the historical facts and analysis presented at the beginning of my essay. There are around 190+ countries in the planet; many of them have rinky-dink official currencies subject to existential risk from time to time. (Even the US dollar and euro — supposedly bastions of stability — have seen their exchange rate jump from $0.80 per euro in 2002 to $1.60 in 2008, only to drop down to $1.20 in 2010, and then jump to the current $1.45.) For additional

colorthoughts on these and other related issues, you may want to read these four articles.I made a site to help newcomers get started. Check out How to mine bitcoins

The big thing that the Bitcoin economy needs at this point is tangible goods and services being offered for BTC. BTCVC is committed to funding suitable BTC based startups, please check out our website if you are a programmer interested in developing a bitcoin related site or have a substantial amount of BTC capital you wish to invest.

Fantastic paper. Thanks. I was in Zimbabwe last year and saw the coinless and currencyless society. All trade was in US Dollars and SA Rand. No coins at all and no new notes. Do you have any updated thoughts about Bitcoin?

Thank you. No new thoughts: everything I wrote last year about Bitcoin still makes sense to me.

I find few recent posts about it online. A flurry last year, then almost nothing. Seems quite. Other developments though with Dwolla and MintChip. Is Bitcoin still happening in your opinion, or just a flash? I did see that there were currently 9 million coins in use, which does show growth.

Actually, there are lots of recent posts about it, and growing media coverage. Check the “Bitcoin News” section at http://bitcoincharts.com for links.

Ok. Great. Thanks.

Pleasant to periodically revisit this prescient article. Today BTC is $34.83.

Thank you!

Just checking in at an historic milestone. A single bitcoin was worth $200 today. Your article remains prescient and frequently linked. Good job!

Thank you.

When I researched bitcoin last March and bought in, the whole thing made complete sense to me for the very reasons you aptly described in your piece. Very well thought out and written! You have re-affirmed my thoughts on the matter. I would be interested to hear your ideas on my initial thoughts:

1. Any fractional reserve banking system will inevitably fail due to inflation

2. Rampant ‘quantitative easing’ in the US (among so many other economic casualties) has accelerated the downward spiral over the last 7 years

3. The only reason the first world is maintaining the illusion of wealth (via ink printed on thin slices of trees) is via its holdings on current and future oil

4. The bitcoin protocol is brilliant and self policing.

5. Bitcoin is non-inflationary by design

And since I checked in at an earlier historic milestone, here’s another one. Bitcoin sailed past $1000 per bitcoin today.

So now 1 USD = 1mBTC.

Yes, it reached and passed $1000 much sooner than anyone, including me, could have ever anticipated. The rate of price appreciation and growth in transaction processing power have been breathtaking.